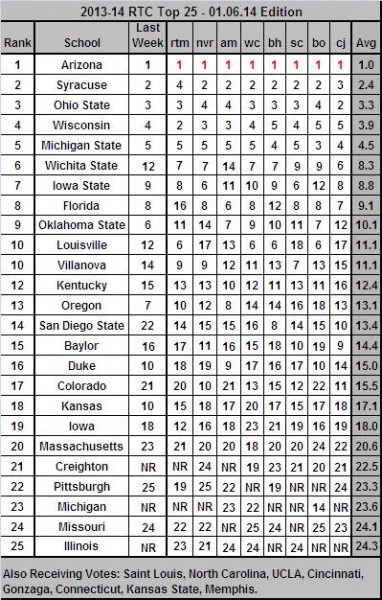

Buy, Sell, or Hold: Big Ten Stock Analysis

Posted by Brendan Brody on January 8th, 2014CBS studio analyst and SI.com columnist Seth Davis wrote his annual article on Monday treating 63 teams as though they were stock market commodities. He gave each squad a designation where he chose to either buy, sell, or hold the stock of each team. When buying, it means that the team may be struggling right now, or struggled at some point recently, but he thinks it has a chance to play much better going forward. When holding, it means he thinks the team is likely to stay where they are, or that he’s unsure about what they will do going forward. When selling, it means that the team appears to have hit its ceiling and can only get worse, or that it doesn’t have much of a chance in his eyes. For example, Wisconsin and Indiana are both in his sell category, but for different reasons. Most of Davis’ takes involving Big Ten teams are spot on, but here’s how each of the eight B1G teams were listed, followed by a few takes about teams that could be classified differently.

Nik Stauskas will play a major role as Michigan attempts to prove to people that they can thrive without Mitch McGary (USA TODAY Sports)

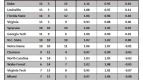

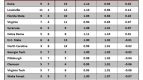

Seth Davis’ Selections

Buy: Michigan State

Hold: Illinois, Minnesota

Sell: Indiana, Michigan, Ohio State, Purdue, Wisconsin

RTC Big Ten Microsite Changes

Michigan: (from Sell to Buy). Everyone has written off Michigan with Mitch McGary’s back injury, but Jon Horford and Jordan Morgan have stepped in and done a nice job in his absence. Davis mainly talks about how brutal the Michigan schedule looks, but 10 or more conference wins is still a real possibility. The win at Minnesota last week already helps quite a bit, and they could very well start 4-0 in the league before they go to Wisconsin on January 18. The stock on Michigan has been low since the team’s early struggles, and it plummeted to great depths when the McGary news broke. But there is still too much talent on this roster to believe that John Beilein’s team can’t finish in the top four of the conference. This could definitely be a value buy if you get the Wolverines now.