Deconstructing NCPA’s “The Price of Poverty in Big Time College Sport”

Posted by nvr1983 on September 15th, 2011Over the past few months there has been a growing sentiment that college players, particularly those in revenue-generating sports, deserve to be paid in addition to the value of their athletic scholarships. The recently released report (full PDF here) by the National College Players Association (NCPA) and Drexel professor Ellen Staurowsky created a lot of buzz and has been used by many proponents of proposals to pay college athletes as a piece of academic evidence to reinforce the notion that the athletes are getting cheated out of millions, if not billions, of dollars. While the report does a good job of making the case that athletes should be more highly compensated than they are at the present time, it is not without its flaws, which come both from the author herself and the people who have already chimed in to use it against the current state of college athletics.

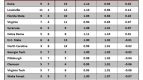

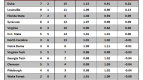

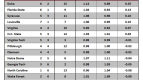

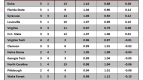

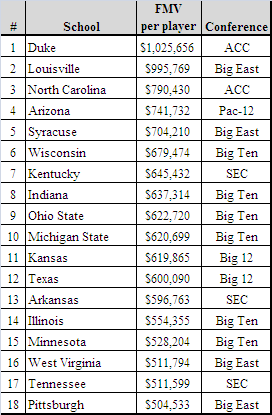

[Ed. note: we created a sorted spreadsheet of the FMV of each basketball program’s players here)

Before we go into the actual data, we should clarify that we approached this study with a skeptical eye because it was funded by the NCPA. A study analyzing the under-payment of a group of individuals funded by an entity that represents that group of individuals should always be viewed critically in the same manner that a medical journal article funded by a pharmaceutical company is viewed. This does not necessarily mean that the report is flawed in some way, just like a study funded by a pharmaceutical company may in fact be valid. It is just that you need to dig a little deeper rather than just looking at the figures presented in the executive summary or the lay press. Having said that, let us take a look at what the study says, what it does not say, and what some of the potential implications are for college sports in general along with possible solutions moving forward.

The report is essentially an analysis of the financial state of Division 1 athletes in college football and men’s college basketball (the two “revenue-generating” sports) in contrast to the money made by the schools and the coaches. The major findings of the study can be summarized rather succinctly:

- “Full-ride” athletic scholarships fall short of “full-ride” academic scholarships as the former are restricted by NCAA rules from covering the full cost of attendance (the figure that schools report to the Department of Education). In 2010-11 they fell short by an average of $3,222;

- The dollar value of the room and board portion of an athletic scholarship falls below of the U.S. Department of Health and Human Services guideline of poverty ($10,890 for a single individual) for 85% of those living on-campus and 86% of those living off-campus with the average athlete on a “full-ride” falling $1874 and $1794 short, respectively;

- Applying the revenue sharing used by the NFL and NBA last season where players get 46.5% and 50% of revenue generated, the average to calculate the “fair market value” of the athletes indicates that football players and basketball players are worth approximately $121,048 and $265,027, respectively, each year;

- For players on teams that were in the top 10 highest estimated fair market value in football, 100% received scholarships that were worth less for room and board than the federal poverty line (average $2,841 below), and in basketball 80% received scholarships that were worth less for room and board than the federal poverty line (average $3,098 below);

- For a set of 21 schools that earn over $30 million in revenue, their players received scholarships with room and board valued on average between $3,070 (on-campus) and $4,967 (off-campus) below the federal poverty line; and

- FBS schools spend on average approximately $350,000 more per each non-revenue-generating sports team than their FCS counterparts do, which, according to the authors, indicates potential cost-saving opportunities that would enable them to maintain the scholarship opportunities for athletes in those sports while still being able to provide enough money for those in revenue-generating sports, as those cost-savings ($6.3 million per year if one assumes an average of 18 non-revenue generating teams per school) would be able to provide approximately $64,000 per player per year in the revenue-generating sports.

- Cover the full-cost of attendance, which, at a rate of $3,222 per athlete per year, would cost nearly $32.8 million for all 120 FBS football teams and nearly $14.2 million for all 338 Division I basketball teams or total approximately $47 million per year. This figure would rise to $94 million per year if Title IX regulations required it to do so, even if these women’s sports did not generate revenue;

- Allow Olympic-style amateurism where the athletes can get endorsements and paid for off-the-field/court activities;

- Place a portion of revenues into a “educational lockbox” that can be “accessed to assist in or upon completion of their college degree;”

- Institute multiple-year scholarships instead of the one-year renewable scholarships that are currently in place; and

- Encourage Congress to investigate college athletics further to make additional reforms.

- College athletes are underpaid. This is true when it pertains to those in revenue-generating sports and more specifically those at high-revenue programs like Duke basketball and Texas football where the programs made $26,667,056 and $93,942,815 in revenue during the 2009-10 season, respectively. If the athletes at these programs were to receive the professional equivalent of this revenue they would be getting respectively $1,025,656 and $513,922 per player per year. Obviously, this far exceeds the value of their scholarships, but if we are going to model this after professional sports, which the author seems to do when it suits her argument, then realistically this should be done with revenue-sharing, so Duke would be subsidizing Florida Atlantic where the basketball program only generated $379,745 during the same period (the lowest of any team in the study – raw data here). Don’t want to spread the wealth? Then say goodbye to the the scholarships at FAU where the players would only receive $14,606 under the same formula, and, according to the school’s Cost of Education data, that falls well short of even the in-state estimate of a little over $20,000, much less the nearly $35,000 for out-of-state students. We are assuming the author does not want to close down the program at FAU, Northern Illinois (“fair market value” of $15,528), or the countless other programs that were not included in the analysis as only 11 of the 31 conferences that receive automatic bids to the NCAA Tournament were included in her calculations. While the $265,027 “fair market value” sounds impressive, it is less so when you cherry-pick the top half of Division I programs to get to that figure while ignoring a large subset of programs making significantly less. The author does not come out and say that the athletes should be paid the quoted “fair market value,” but many in the press have latched onto these figures as a realistic amount that the athletes should be paid without realizing that doing so would probably result in closing down nearly half of the programs in FBS/Division I, since the cited figures overestimate the average “fair market value” by focusing on just the high revenue-generating programs.

- The idea that “full-rides” do not cover college expenses is ridiculous. This is one idea that we can get fully behind. The reported basis of this decision — that academic scholarships can fully cover the cost of attendance while athletic scholarships don’t — comes from the NCAA’s definition of amateurism. According to the report, the average scholarship currently falls $3,222 short of the cost of education figure that the schools report. While this figure doesn’t seem like much, it does not seem reasonable to provide this to non-athletes but not to athletes. The estimated cost to make up this difference for every scholarship player in FBS football and Divison I college basketball would be approximately $47 million. Even if this figure was matched for women’s athletes for Title IX reasons it would still only come to about $94 million. Some of this can already be met by the underutilized Special Athlete Fund and Student-Athlete Opportunity Fund. Given the enormous size of current TV contacts that could easily provide the necessary additional money, this seems like a feasible and reasonable recommendation. In addition, due to the 1973 ruling that prohibits schools from offering anything beyond a one-year renewable scholarship, athletes are often subject to the whims of the coaches (oversigning, anyone?) or the chance of an injury (likely sports-related) costing them that scholarship. Although schools might feel that this is the best method for them (and it is), the fact that athletes cannot even negotiate for a guaranteed four-year scholarship between schools appears ludicrous given the chances that their athletic performance may not live up to expectations, even if they do hold up the student end of the student-athlete ideal.

- FBS schools do spend more than FCS schools on non-revenue-generating sports. You will not find an argument from us on this based on the pure numbers. The authors posit this as a rationale for potential cost-savings that could be implemented to help maintain the same number of scholarships in these sports while still paying athletes in revenue-generating ones the aforementioned real full-ride. This is fine, except it misses two very important points: (1) FBS schools generally field teams that are nationally competitive and are essentially forced to travel across the country for bigger events, while smaller, less-competitive schools are content to compete in smaller local meets which satisfy the level of talent on their teams, and (2) the larger geographic regions in FBS conferences necessitate more costly travel (look at the conference maps and notice how FBS conferences tend to cover a wider geographic area than FCS conferences with a few exceptions).

- The poverty line analysis is wrong. The author attempts to make the case that full-ride scholarships leave the vast majority of athletes (approximately 85% overall) in poverty due to the value of the room and board of their scholarships. This is wrong on so many levels that it’s hard to figure out where to begin. Let’s start with the part that is right; the theoretical value of room and board for many scholarships is below $10,830 (the federal poverty line for a single individual). Our issue comes with how the author tries to use that figure to make the inflammatory claim that athletes are essentially destitute. While there are various ways to define poverty, what it essentially boils down to is having inadequate funds to maintain an adequate standard of living. Most college athletes are not walking around campus wearing a Rolex or driving a Mercedes, but you would be hard-pressed to say that they are not provided with proper shelter or adequate nutrition. Quite simply, the author’s assertion about athletes living below the poverty line is nothing more than yellow journalism, which is particularly galling given the growing number of people actually living below the poverty line. Could athletes benefit from a little extra spending money? Sure. Are they living in poverty? Nice try.

- The fair market values are misleading. The author does not propose to pay the players at their fair market value, but a number of writers have already chimed in arguing for it, so it is worth commenting on this topic. As we stated earlier, the fair market values are misleading and would lead to numerous externalities that the author has either not considered or simply not discussed. For example, at Duke, where the reported fair market value of the average player is proposed to be in excess of $1 million, it doesn’t seem reasonable that a player like Todd Zafirovski would merit the same value as Austin Rivers would, and consequently the players would likely be paid different amounts. Or, if they were paid similar amounts, Duke might just decide not to keep Zafirovski on the team and pocket the extra million. In addition, the quoted fair market values ignore basic potential business issues like costs at less profitable schools that might make competing and paying fair market value untenable. This would inevitably lead to numerous programs having to shut down or render the playing field even more uneven. If only high-revenue programs are able to give more money to their players, this would create an even more unequal playing field and could eventually lead to a separation of high-revenue and low-revenue programs into another subdivision, or worse, some kind of work stoppage akin to what the NBA is currently going through. Given the inherent transient lifespan of the college athlete, this situation could be devastating.