College Basketball’s Unmentionable: the Issue of Point Shaving?

Posted by rtmsf on September 13th, 2010It’s not often that we stumble across academic research papers these days, but last week we happened upon one from the Department of Economics at Temple University in Philadelphia entitled, “Point Shaving in NCAA Basketball: Corrupt Behavior or Statistical Artifact?” In the paper, Professors George Diemer and Mike Leeds use various statistical analyses to conclude that not only does point shaving regularly occur in college basketball, but it occurs in two specifically defined situations. Their conclusion builds upon prior work by Professor Justin Wolfers at Penn’s Wharton School, who found a few years ago that approximately 1% of lined NCAA basketball games fell into an outlier suggestive of gambling-related corruption (the math works out to approximately thirty games per year).

Using data from a comprehensive sample of 35,000+ lined games from 1995-2009, Diemer and Leeds confirmed Wolfers’ underlying finding — statistical indicators suggest that point shaving in college basketball exists — while giving us a richer explanatory context of when it happens. So when does it happen? According to the authors, the data shows that the higher a point spread goes, there is greater statistical evidence of an increased incidence of point shaving. In other words, there is a greater likelihood of favorites shaving off a few points when they’re favored by twenty points than there is when they’re favored by fifteen, ten or five points. The intuitive logic behind this premise is that in games with large point spreads, the favorite (a far better team) can afford to give up a couple of meaningless buckets to its opponent at the end of the game because it will not impact the primary outcome — the favorite still gets the win, regardless of whether it wins by nineteen or fourteen points. Conversely, in games with increasingly smaller point spreads, players (or coaches, or referees) trying to shave points would have to walk a very fine line between trying to still win the game while simultaneously staying under the point spread threshold. Given the thousands of confounding factors facing any one person trying to manipulate a final score in such a way at the close of a game, this scenario would seem much more difficult to pull off.

The second qualifier that Diemer and Leeds found was that the statistical tendency for the incidence of point shaving to increase along with the betting line only holds during regular season games; during the postseason (conference tournaments, the NIT, and the NCAA Tournament), there is no such effect. The logical premise supporting this contention is similar to the above — in postseason games, there is a much greater level of importance from all parties involved (not to mention public attention) to perform at peak capacity from start to finish throughout the game. During the regular season, where presumably every team lives to play another day, this underlying motivator is less so.

You’re probably wondering how the authors can know something is fishy simply from looking at a bunch of excel spreadsheets of point spreads and game results over fifteen years. After all, it’s not like they can show specific instances of point shaving by anyone in particular (such as Toledo’s Sammy Villegas), nor can they isolate which individual games were the most likely candidates of corruption. They can only tell us that, given a normal expectation of how data aggregates in a gambling market, there are some trends that cannot simply be explained by random chance. Similar to determining that numerous Chicago public school teachers were helping their students cheat on standardized exams or any number of other economic studies to explain human behavior at the macro level, the answer is that this is what economists do.

Obviously, just because it’s their job doesn’t make it sacrosanct. Anticipating some criticism of the study, we asked Diemer and Leeds specifically about two possible issues with their findings. First is whether the concept of line shading — when bookmakers move their betting lines one way or another to maximize their own profits — impacts their findings. After all, if the assumption is that a gambling marketplace seeks to establish equal wagering from bettors on both sides of the point spread, then movement away from that magical 50/50 nexus could sway performance (i.e., the point spread doesn’t represent the true market odds). The authors refute this by suggesting that if bookmakers were manipulating the line in such a manner, then the data would still represent as a symmetrical distribution — but it doesn’t. No matter where the data falls on the curve, it shows the same result: as point spreads increase, there is a greater incidence of point shaving.

The second criticism we asked them about is that the authors defined postseason to include games that probably have different values to different teams, depending on their specific situation. For example, no college basketball fan will argue that a first round game in the NIT for a team who thinks it should have been in the NCAAs will get a maximum effort; similarly, some teams in conference tournaments mail it in if they feel that their NCAA/NIT position is secure. And yet, those two pieces of the “postseason” data represent the vast majority of games in the sample. Diemer and Leeds reponded to this by stating they would have had serious sample size concerns had they only included NCAA Tournament data in their study, but were quick to remind us that the key takeaway was not outcome-specific (win or lose), but rather outcome relative to the betting line (cover or not cover).

There is room for further debate here. Regardless of what you believe may cause the statistical anomaly, there appears to be strong evidence that favorites carrying high point spreads are coming up just short of that spread with much more regularity than those in the postseason. And it’s not happening randomly; it’s happening with purpose. As we’ve stated before on this very site with respect to the Tim Donaghy Scandal in the NBA, with nearly 350 NCAA teams as well as countless players, referees and coaches to account for, there is ample opportunity for an occasional smidge of foul play. Short of an information leak or an obvious series of on-court errors, how would anyone really know if a player on some unknown/unwatched Big Sky or Atlantic Sun team was shaving points at the end of a blowout? How would a referee who stands to double or triple his take-home in one night by calling a few extra fouls at the end of a blowout get caught? What about the coach who pulls his starters at just the right time to allow the opponent to make a last-minute run to get the final score under twenty points — how do you catch that guy?

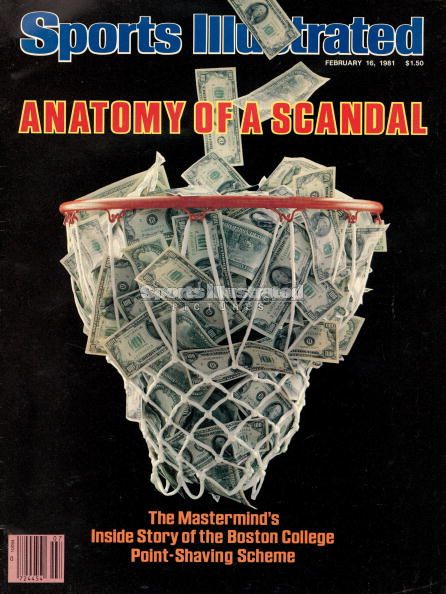

It’s a difficult issue, but it’s no joke; not only is point shaving a federal crime, but its mere presence (or even just a hint of it) sullies the entire game. With Diemer and Leeds’ findings now available for public consumption, there appears to be enough evidence supporting the contention (point shaving exists in college basketball) to force the NCAA to take notice. All it takes is a major scandal to impugn the sport, and there are obviously billions of dollars in television rights and ticket sales on the line. We’re not suggesting that sniffing out these isolated incidents is easy to do, but we are hopeful that the well-paid executives in Indianapolis recognize that both the opportunity and evidence supporting point shaving exist and that they are developing additional methods to combat it. The head-in-the-sand routine simply isn’t an acceptable response in the face of such compelling evidence.

Hi guys –

Fascinating work here.

My one quibble with the work not mentioned in the above article is this: all of this relies heavily on the efficient market hypothesis. Financial economists have long relied on the EMH for analyzing stock returns. However, there are many economists that have disputed whether or not the EMH actually exists for stocks.

My question is this: if we can’t necessarily believe that the EMH holds for something relatively efficient as the stock market, how can we assume that sports betting is an efficient market?

I’m not saying that I don’t believe their findings or that there isn’t point shaving in college bball. I just don’t think the authors have done a sufficient job of convincing me that sports betting is 100% efficient market.

Ben, given your background and experience, I’m sure that’s a valid criticism. What could the authors do to mitigate or eliminate that concern, if anything?

I know this sounds stupid, if I were reviewing this for a journal, I’d ask to see well-reasoned argument as to why I’d expect sports betting to be an efficient market. Are there betting volume numbers to back that up?

There are multiple EMHs (something about strong and weak, but I can’t recall the distinction), does this assume one versus the other? etc. etc.

The authors give this part of the paper the short shrift.

Doesn’t sound stupid to me, Ben. I think the authors will check in on the post, but I’ll make sure they see your comment separately. Thanks.

I have a couple more quibbles:

1) This is related to Ben’s point about the EMH assumption. I don’t see why line shading cannot cause a double peak. There are a variety of types of teams that will draw more bettors than usual, not just favorites. For example: teams on winning streaks, road favorites, big name schools, teams from BCS conferences (when playing minnows). Having just listed all those, I now see that MOST of them should be favorites, so I guess the shading should GENERALLY be in the same direction. But not always. If we have overlapping distributions of shaded-down, shaded-up, and not-shaded, couldn’t it be reasonable to see a multimodal distribution?

2) I’m not sure if this one is valid, but intuitively it’s an issue to me. Their sample size for the 19+ point spread postseason games is 99. As someone who has gambled on sports in the past, and seen results/trends fluctuate from one year to the next (particularly I’m thinking of data derived from the NFL, which has 296 games each year), this seems a dangerously small sample from which to draw a conclusion. This is especially true when their conclusion is essentially “despite the fact that you can visually see the same double-peak pattern in the postseason data, the significance test says it’s not really there.” Aren’t they claiming that the pattern is caused by chance in the postseason, but by point-shaving in the regular season? Maybe I am misunderstanding or misinterpreting this section.

3) I guess this is just another restatement of the EMH assumption problem, but they seem to be claiming that any deviation from their assumptions that they haven’t explained must be due to point-shaving. I just thought of this, and no time to go back and re-read the article, but did they account for simple variables like home/away, conference/nonconference in their analysis? I don’t recall seeing that.

That said, I am not arguing that there is NOT point-shaving. I am just not sure that their evidence shows that there IS.