Bubble Trouble: Volume II

Posted by Connor Pelton on February 11th, 2012In this weekly piece we will be comparing blind tournament résumés. Each week we will take three Pac-12 teams that are on the bubble and compare them to three national teams that are facing the same fate. Since the Pac-12 is in such a down year, we realize that we are going to run out of NCAA Tournament bubble teams pretty quickly. That’s why in the coming weeks you will see some NIT and even CBI bubble predictions. If you did not see last week’s post explaining everything, please go here.

*All numbers and rankings as of February 11

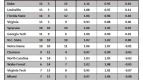

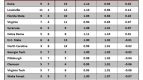

| Team 1 | Team 2 |

| Winning Percentage: .680 | Winning Percentage: .666 |

| RPI: 63 | RPI: 58 |

| SOS: 62 | SOS: 66 |

| Quality Wins (Opponents’ RPI Rank): 47 | Quality Wins (Opponents’ RPI Rank): 28, 48 |

| Bad Losses (Opponents’ RPI Rank): 106, 72, 75, 76 | Bad Losses (Opponents’ RPI Rank): 203, 82, 77 |

This is a very close battle. We’ll start by calling the winning percentages, RPI’s, and SOS’s even; There’s just not too big of a difference in any given category to give the edge to a specific team. Team two, however, edges out their counterpart in quality wins. I’m going to call the bad losses even, because even though team one has four of them to team two’s three, three of their four are all ranked in the seventies of the RPI. Team two has a 200-level loss in there, which is a big no-no on a résumé. I’m still taking team two to edge out team one, but I honestly wouldn’t feel good sending either of these teams to the Big Dance. Click the jump to see whom the résumés really belong to.

Team One is Arizona. The quality win came against California, while the bad losses were to UCLA, Oregon, Colorado and Washington. Team Two is Xavier, who got their pair of quality wins against Vanderbilt and St. Joseph’s. Their bad losses are to Hawaii, La Salle, and Dayton. Now that we know the teams, I still like the Musketeers. The committee will give them a slight pass for the Hawaii loss as it was a late-night-before-Chirstmas Eve game coming a day after a tough loss to a good Long Beach State team.

***

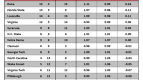

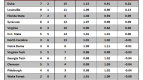

| Team 1 | Team 2 |

| Winning Percentage: .681 | Winning Percentage: .666 |

| RPI: 35 | RPI: 75 |

| SOS: 40 | SOS: 73 |

| Quality Wins (Opponents’ RPI Rank): 2 | Quality Wins (Opponents’ RPI Rank): 63 |

| Bad Losses (Opponents’ RPI Rank): 53, 62, 34, 41, 50 | Bad Losses (Opponents’ RPI Rank): 97, 101, 106 |

Easy choice here in team one. They have the better winning percentage, RPI, SOS, their lone quality win is 61 spots better than team two’s and you could even make an argument that their five bad losses are better than team two’s three. Team one’s highest ranked bad loss is ranked number 62 in the nation, while all three of team two’s are almost in the 100s. No question in to whom has the better résumé, now let’s take a look at who they really belong to and see if it changes anything.

Team One is Miami (Florida). Their quality win was the thriller at Duke, while the bad losses were to Mississippi, West Virginia, Purdue, Virginia, and NC State. These bad losses are truly not that bad, but that’s what happens when you are ranked in the 30s of the RPI. Team Two is Colorado, who had their lone quality win over Arizona. They also have two other “semi-quality” wins inside the Pac-12 against Washington and Oregon. The three bad losses came against Maryland, Stanford, and UCLA. Unfortunately for Colorado, their low RPI, lack of quality wins, and failure to win on the road could very well come back to hurt them as it did last year on Selection Sunday. The Buffs are 2-5 in true road games, with those wins coming against teams with a combined record of 17-29. If Colorado is up against a team like the Hurricanes for the final spot into the field of 68, expect them to get left out again.

***

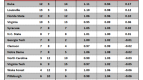

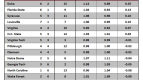

| Team 1 | Team 2 |

| Winning Percentage: .708 | Winning Percentage: .565 |

| RPI: 72 | RPI: 80 |

| SOS: 92 | SOS: 22 |

| Quality Wins (Opponents’ RPI Rank): N/A | Quality Wins (Opponents’ RPI Rank): 46, 65, 49 (2) |

| Bad Losses (Opponents’ RPI Rank): 76, 141, 75 | Bad Losses (Opponents’ RPI Rank): 95, 110, 154 |

I’ll take team one here by the slimmest of margins. While their winning percentage is incredibly bad, a Top 25 RPI and four Top 70 quality wins are very impressive. Still, I’m taking team one. A team’s record is big in my eyes and team two’s is just too close to .500.

Team One is Oregon, with their bad losses coming against Washington, Oregon State, and Colorado. Team Two is Oklahoma, with the quality wins coming against Oral Roberts, Arkansas, and Kansas State (2). Their bad losses were to Cincinnati, Oklahoma State, and Texas A&M.

If you didn’t figure it out by looking at the chart, and it wasn’t even more obvious to you after seeing the teams, we’ve reached our first NIT bubble résumés. That makes the Sooners’ 13-8 (3-10 in Big 12) record doesn’t seem as bad, but it still doesn’t hold up against a 17-7 record. What hurts Oregon so much is that “N/A” in the quality wins spot. Every chance they get, whether it’s against Vanderbilt, Virginia, or California, they blow it. The Ducks will face Cal in Berkeley again on February 16, and could very well meet up once more in the Pac-12 Tournament, but those will be Oregon’s final chances at picking up a quality win. Besides for Oklahoma’s bad record and Oregon’s failure to show up in big games, there’s one other thing that’s alarming about these résumés: Both teams each have a bad loss to their rival, and in Oregon’s case, they have two. How are you supposed to show the selection committee that you are worthy to face solid teams night in and night out in March when you can’t even beat your lesser rival? Both teams will get one more chance against Oklahoma State (February 22) and Oregon State (February 26), and you know both games will be heavily watched by the selection committees. The question is, can they shake off the pressure that comes with the rematch after they already lost? The answer could land one team in the NIT and the other in the CBI.