Vegas Odds Update #1: UNC No Longer the Title Favorite

Posted by rtmsf on December 16th, 2011We’re a little over a month into the 2011-12 season and most teams have played somewhere in the range of eight to ten games. That’s enough time to get a decent sense as to teams’ potential for the rest of the season, rather than relying on little more than preseason guesswork and conjecture. At the end of October, we went through an exercise analyzing Vegas futures odds and came to the conclusion that North Carolina and Kentucky were the odds-on favorites to cut down the nets next April (a normalized combined total chance of 20%). As of December 15, Vegas still thinks similarly, although with two key differences — first, Kentucky, at +300 and a 14.6% normalized chance to win the title, has moved ahead of North Carolina, who still sits at +350 and now has a 13.0% chance. Secondly, the two favorites have a combined 27.6% chance to win it all according to the oddsmakers, which basically means that if you played the NCAA Tournament four times, either UNC or UK would win it once.

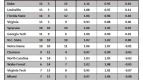

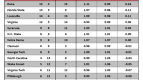

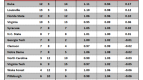

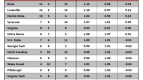

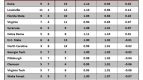

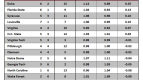

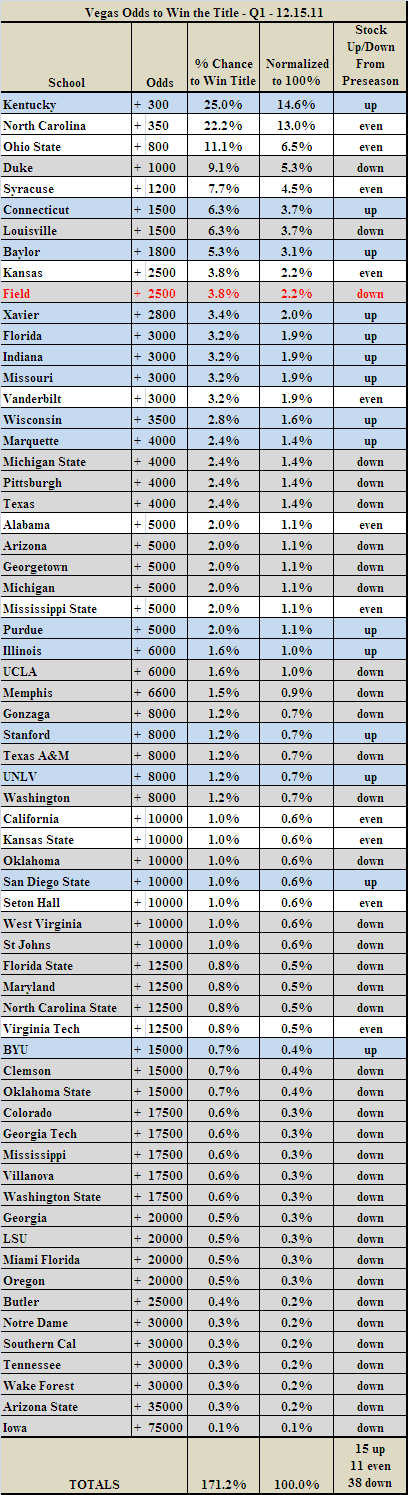

Here are your preseason odds for the sake of reference. Note that these odds came from The Greek and this discussion is for entertainment purposes only. The table below provides the futures odds (e.g., +300), which converts to a percentage chance to win (e.g., 25.0%), but also a normalized change to win if all chances added up to 100%. We also provide a simple up (blue)/down (gray)/even (white) stock measurement based on whether a team’s odds profile has risen or fallen since October. We provide some analysis of this table after the jump.

Some quick and dirty thoughts after the first month of the season:

- Out of the 63 teams (plus the Field) that they provide odds for, only 15 schools’ profiles rose (24%), 11 schools stayed even (18%), and the rest (58%) dropped. The highest riser by far is Chris Mack’s Xavier squad — the Musketeers went from off the map at +10,000 (essentially 100 to 1) to +2,800 (28 to 1). Marquette also made a big jump in the first month of the year, going from +10,000 to +4,000 now.

- It’s not so much that North Carolina dropped behind Kentucky as UK jumped ahead of the Heels. The Wildcats were set at +500 prior to the season with UNC at +350, but UNC has stayed static while John Calipari’s young Wildcats have moved up to +300. They may go back and forth in the top two spots all season, but short of a major injury, it’s unlikely that anybody else will replace one of them this season.

- UCLA and Memphis are the elite schools that have fallen hardest, with both schools going from the preseason top 10 in the odds (UCLA: +1,800; Memphis: +2,000) to pretty far down the list (+6,000 and +6,600, respectively). Frankly, there are quite a few schools we’d take below either of those teams, even now. Butler went from +5,000 to +25,000, and Villanova from +5,000 to +17,500, both precipitous drops as well.

- It’s interesting that the Field dropped marginally from +2,000 to +2,500, as it suggests that Vegas doesn’t think very much about the Wichita State, Creighton, Belmont, Iona, Cleveland State, Murray State, Harvard crowd this year.

- A nifty exercise in risk and discipline would allow you to buy every team from Texas (+5,000) and every team on the list up to Connecticut (+1,500) and still guarantee yourself at least a break-even point. Another way to look at the list is through markers — the top seven teams (through Louisville) collectively have a 50% or better chance to win it all this season. The top 20 teams down through Texas have a 75% chance or greater as a group.

- Much of the change among teams’ placement reflects right-sizing through empirical evidence (games played). The top 10 schools in terms of their odds roughly mimics the top 10 in the polls — not necessarily in the order, but mostly the same schools. It’ll be interesting to track how this develops during the next month of the season. We’ll check back in on this in mid-January after conference play gets started.